Horizontal Skew

外汇网2021-06-19 13:45:59

150

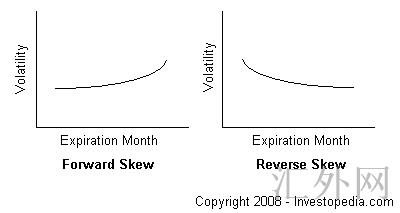

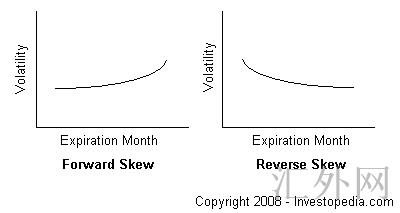

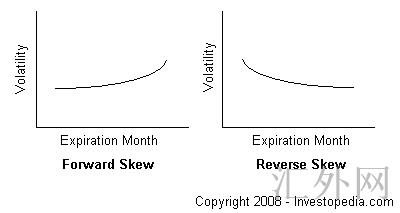

The difference in implied volatility (IV) across options with different expiration dates. Horizontal skew refers to the situation where at a given strike price, IV will either increase or decrease as the expiration month moves forward into the future. A forward horizontal skew occurs when volatilities increase from near to far months. A reverse horizontal skew occurs when volatilities decrease from near to far months.

标签:

随机快审展示

加入快审,优先展示

推荐文章

- 黑马在线:均线实战利器 9284 阅读

- 短线交易技术:外汇短线博弈精讲 4514 阅读

- MACD震荡指标入门与技巧 4645 阅读

- 黄金操盘高手实战交易技巧 5067 阅读

- 做精一张图 3761 阅读

热门文章

- 港币符号与美元符号的区别是什么啊? 27360 阅读

- 我国各大银行汇率为什么不一样啊? 17339 阅读

- 越南盾对人民币怎么算的?越南盾对人民币汇率换算方法是什么 12321 阅读

- 百利好环球欺诈,不给出金,无法联系。 11369 阅读

- 港元符号是什么啊 港元符号跟美元符号是一样吗 10489 阅读